Capella Healthcare, Inc. Announces Second Quarter 2012 Results

August 3, 2012Franklin, Tennessee. August 3, 2012 – Capella Healthcare, Inc. (“Capella”) today announced financial and operating results for the three and six months ended June 30, 2012.

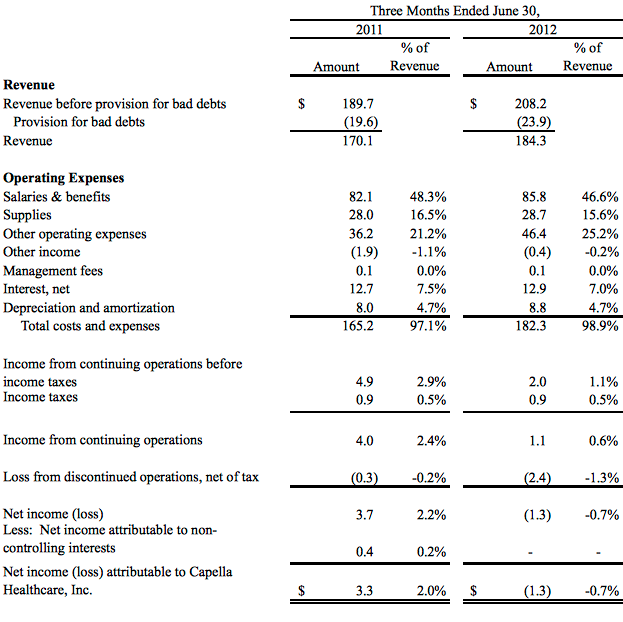

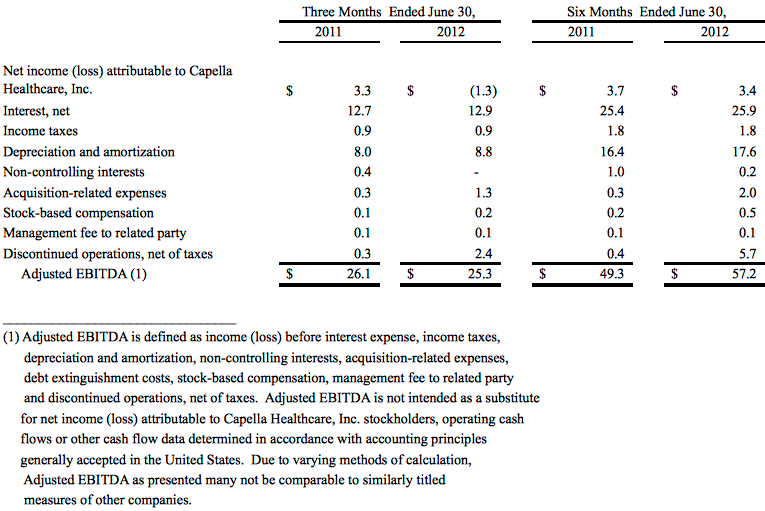

Revenue for the second quarter of 2012 totaled $184.3 million, an increase of 8.3%, compared to $170.1 million in the second quarter of 2011. Adjusted EBITDA for the second quarter of 2012 totaled $25.3 million, compared to $26.1 million in the second quarter of 2011. Net income from continuing operations for the second quarter of 2012 totaled $1.1 million, compared to $4.0 million in the second quarter of 2011.

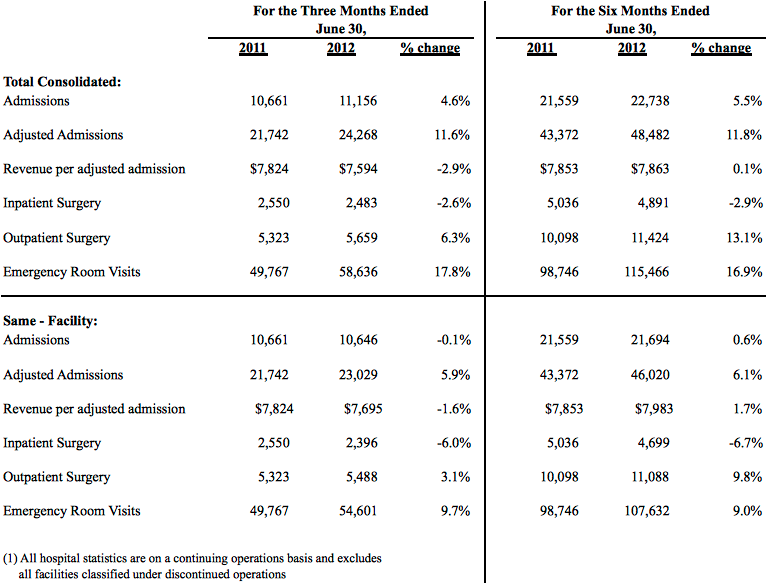

Second quarter admissions and adjusted admissions increased 4.6% and 11.6%, respectively, compared to the prior year quarter. Same-facility admissions decreased 0.1% and adjusted admissions increased 5.9%, respectively, compared to the prior year quarter. Consolidated revenue per adjusted admission decreased 2.9%, compared to the prior year quarter. Same-facility revenue per adjusted admission decreased 1.6% compared to the prior year quarter.

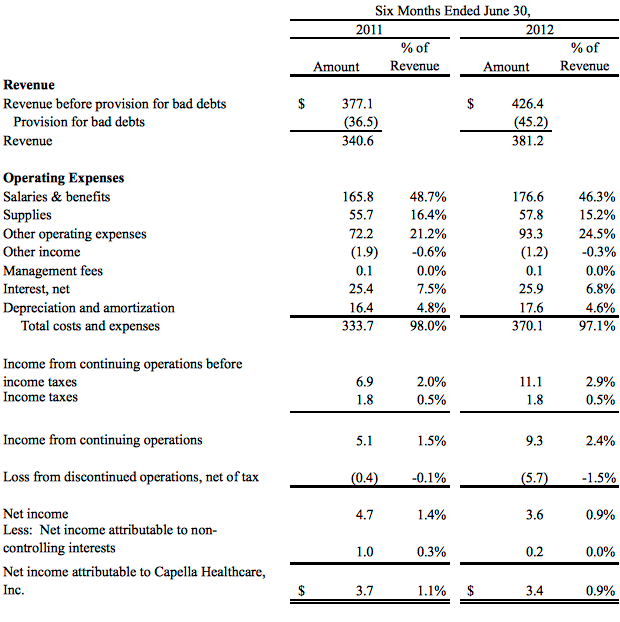

Revenue for the six months ended June 30, 2012 totaled $381.2 million, an increase of 11.9%, compared to $340.6 million in the prior year period. Adjusted EBITDA for the six months ended June 30, 2012 totaled $57.2 million, compared to $49.3 million in prior year period, representing a 16.0% increase. Net income from continuing operations for six months ended June 30, 2012 totaled $9.3 million, compared to $5.1 million in the prior year period.

For the six months ended June 30, 2012, admissions and adjusted admissions increased 5.5% and 11.8%, respectively, compared to the prior year period. Same-facility admissions and adjusted admissions increased 0.6% and 6.1%, respectively, compared to the prior year period. Consolidated revenue per adjusted admission increased 0.1% and same-facility revenue per adjusted admission increased 1.7%, each compared to the prior year period.

Commenting on the results, Dan Slipkovich, Chairman and Chief Executive Officer of Capella Healthcare, Inc. said, “We are pleased to show solid results for the second quarter. We continued to execute our key strategies by adding Muskogee Community Hospital to our family, effective July1, and by making significant investments in information technology, quality and patient care at our hospitals. We are proud of our hospitals’ progress and are confident that we are investing our time, energy and dollars in the resources that position us for future success.”

About Capella Healthcare

Based in Franklin, TN, Capella Healthcare owns and/or operates general acute-care hospitals in seven states. With the philosophy that all health care is local, Capella collaborates with each hospital’s medical staff, board and community leadership to take care to the next level. The company has access to significant leadership and financial resources, reinvesting in its family of hospitals to strengthen and expand services and facilities. For more information visit the website at www.CapellaHealth.com.

Conference Call

Capella will host a conference call for investors at 9:00 a.m. Central Standard Time today. All interested investors are invited to access the call by dialing: 877-806-6964, passcode: 12443258. A replay of the call will be available for a period of 30 days, beginning approximately one hour after the call has concluded. Instructions to access the audio recording can be found on the Investor Relations section of the Company’s website at www.CapellaHealth.com. A copy of the Company’s Form 10-Q for the period ended June 30, 2012 may be obtained via the Company’s website when filed with the SEC.

Cautionary Statement about Preliminary Results and other Forward-Looking Information

This press release contains forward-looking statements based on current management expectations. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statements. These factors include, but are not limited to, (1) the impact of healthcare reform on our financial position and results of operations; (2) the impact of efforts by federal and state healthcare programs and managed care companies to reduce reimbursement rates for the services provided by our facilities; (3) the impact of the lingering effects of the economic downturn; (4) the collectability of accounts receivable related to patient accounts; (5) our ability to recruit and maintain favorable and continuing relationships with qualified physicians and other healthcare professionals who use our facilities; (6) our ability to comply with extensive laws and government regulations related to the healthcare industry and the potential adverse impact of government investigations, liabilities and other claims asserted against us; (7) potential competition from other hospitals or healthcare providers, including physicians; (8) the concentration of our facilities in a small number of states; (9) the impact of interruptions to or changes in our information systems; (10) our ability to obtain adequate levels of general and professional liability insurance; (11) our ability to ensure confidential information is not inappropriately disclosed and that we are in compliance with federal and state health information privacy standards; (12) the resources needed for, or unforeseen liabilities related to, future capital commitments, acquisitions or joint ventures; (13) our ability to integrate and improve successfully the operations of acquired facilities; (14) our ability to enhance our hospitals with the most recent technological advances in diagnostic and surgical equipment; (15) our substantial indebtedness and adverse changes in credit markets impacting our ability to receive timely additional financing on terms acceptable to us to fund our acquisition strategy and capital expenditure needs; and (16) other risk factors described in our annual report on Form 10-K for the year ended December 31, 2011 filed with the Securities and Exchange Commission. Many of the factors that will determine our future results are beyond our ability to control or predict. In light of the significant uncertainties inherent in the forward-looking statements contained herein, readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Capella Healthcare, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(Dollars in millions)

Capella Healthcare, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(Dollars in millions)

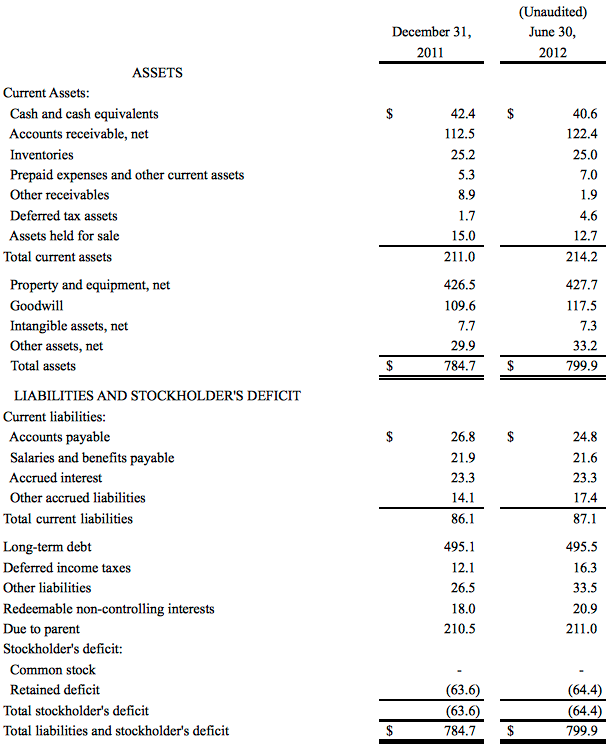

Capella Healthcare, Inc.

Condensed Consolidated Balance Sheet

(Dollars in millions)

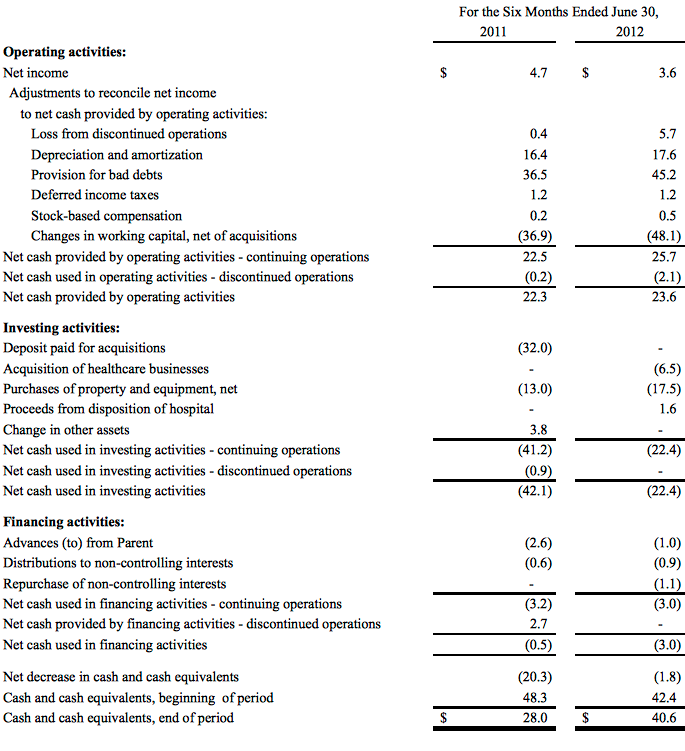

Capella Healthcare, Inc.

Condensed Consolidated Statement of Cash Flows (Unaudited)

(Dollars in millions)

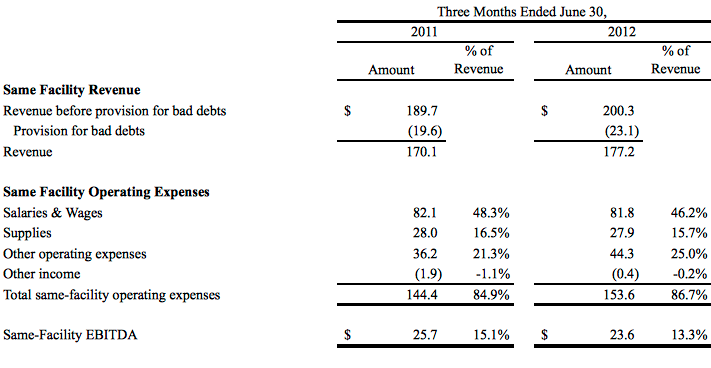

Capella Healthcare, Inc.

Supplementary Same-Facility Financial Information (1) (Unaudited)

____________________

(1) All information is on a same-facility basis. Same-facility represents hospitals that we have owned for more than one year. Information above excludes the acquisition of the 60% interest in Cannon County Hospital, LLC, which owns DeKalb Community Hospital and Stones River Hospital.

Capella Healthcare, Inc.

Supplemental Non-GAAP Disclosures

Adjusted EBITDA – Reported (Unaudited)

(Dollars in millions)

Capella Healthcare, Inc.

Operating Statistics (1) (Unaudited)