Capella Healthcare Announces First Quarter 2012 Results

May 4, 2012INVESTOR CONTACT:

Denise Warren

SVP/CFO

615-764-3013

MEDIA CONTACT:

Beth Wright

VP – Communications

615-764-301

Franklin, TN. May 4, 2012 – Capella Healthcare, Inc. (“Capella”) today announced financial and operating results for the three months ended March 31, 2012.

Revenue for the first quarter of 2012 totaled $196.9 million, an increase of 15.4%, compared to $170.5 million in the first quarter of 2011. Adjusted EBITDA for the first quarter of 2012 totaled $31.8 million, compared to $23.1 million in the first quarter of 2011. Net income from continuing operations for the first quarter of 2012 totaled $8.2 million, compared to $1.1 million in the first quarter of 2011.

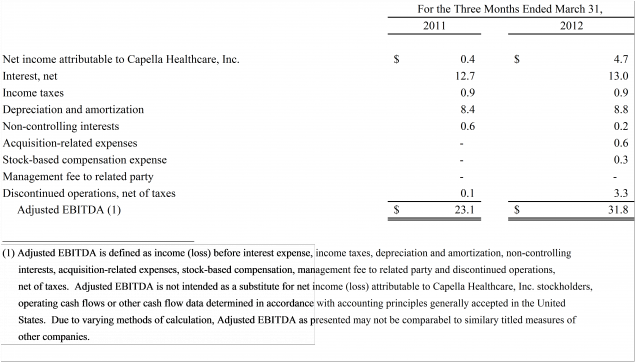

In the first quarter of 2012, admissions and adjusted admissions increased 6.3% and 12.0%, respectively, compared to the first quarter of 2011. On a same-facility basis, admissions and adjusted admissions increased 1.4% and 6.3%, respectively, compared to the prior year quarter. Consolidated revenue per adjusted admission increased 3.1%, compared to the prior year quarter. On a same-facility basis, revenue per adjusted admission increased 5.0% compared to the prior year quarter.

Capella’s results for the three months ended March 31, 2012 include the following adjustments to revenue.

Supplemental Hospital Offset Payment Program (“SHOPP”)

Capella’s Oklahoma facilities participate in the State of Oklahoma’s SHOPP. On January 17, 2012, the Centers for Medicare & Medicaid Services (“CMS”) approved the SHOPP with an effective date of July 1, 2011. The legislation related to the SHOPP was signed into law by the Governor of Oklahoma on May 13, 2011, but subject to approval by CMS. The SHOPP, with an initial term of three fiscal years, allows for the establishment of a hospital provider fee assessment on all non-exempt Oklahoma hospitals. Capella plans to use revenue from this assessment to maintain hospital reimbursement from the SoonerCare Medicaid program and to secure additional matching Medicaid funds from the federal government. Since CMS approval of the program did not occur until January 17, 2012, Capella recorded revenues and expenses associated with the period of July 1, 2011 through December 31, 2011 in the first quarter of 2012.

Rural Floor Provision Settlement

The Balanced Budget Act of 1997 (“BBA”) established a rural floor provision, by which an urban hospital’s wage index within a particular state could not be lower than the statewide rural wage index. The wage index reflects the relative hospital wage level compared to the applicable average hospital wage level. BBA also made this provision budget neutral, meaning that total wage index payments nationwide before and after the implementation of this provision must remain the same. To accomplish this, CMS was required to increase the wage index for all affected urban hospitals, and to then calculate a rural floor budget neutrality adjustment to reduce other wage indexes in order to maintain the same level of payments. Litigation has been pending for several years contending that CMS miscalculated the neutrality adjustment from 1999 through 2011. The litigation, in which Capella and several other hospital companies participated, has now been settled with an agreement signed on April 5, 2012. As a result of the agreement, Capella expects to receive additional Medicare payments by June 30, 2012. Capella recorded revenue and expenses related to the rural floor provision settlement during the first quarter ended March 31, 2012.

Capella recorded revenue and expenses related to prior period SHOPP and the rural floor provision settlement of $13.6 and $5.1 million, respectively, during the three months ended March 31, 2012.

“We remain incredibly proud of our hospitals’ progress, confident that we are investing our time, energy and dollars in the resources most strategic for success,” said Dan Slipkovich, Chairman and Chief Executive Officer. “In spite of the challenges the industry is facing, we are optimistic about our future. It continues to be a time of great opportunity, and while we will continue to remain disciplined and selective, we fully anticipate growing the family of Capella hospitals in the next few months.”

About Capella Healthcare

Based in Franklin, TN, Capella Healthcare owns and/or operates general acute-care hospitals in seven states. With the philosophy that all health care is local, Capella collaborates with each hospital’s medical staff, board and community leadership to take care to the next level. The company has access to significant leadership and financial resources, reinvesting in its family of hospitals to strengthen and expand services and facilities. For more information visit the website at www.CapellaHealth.com.

Conference Call

Capella will host a conference call for investors at 9:00 a.m. Central Standard Time today. All interested investors are invited to access the call by dialing: 877-806-6964, passcode: 77145015. A replay of the call will be available for a period of 30 days, beginning approximately one hour after the call has concluded. Instructions to access the audio recording can be found on the Investor Relations section of the Company’s website at www.CapellaHealth.com. A copy of the Company’s Form 10-Q for the three months ended March 31, 2012 may be obtained via the Company’s website when filed with the SEC.

Cautionary Statement about Preliminary Results and other Forward-Looking Information

This press release contains forward-looking statements based on current management expectations. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statements. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statements. These factors include, but are not limited to, (1) the impact of healthcare reform on our financial position and results of operations; (2) the impact of efforts by federal and state healthcare programs and managed care companies to reduce reimbursement rates for the services provided by our facilities; (3) the impact of the lingering effects of the economic downturn; (4) the collectibility of accounts receivable related to patient accounts; (5) our ability to recruit and maintain favorable and continuing relationships with qualified physicians and other healthcare professionals who use our facilities; (6) our ability to comply with extensive laws and government regulations related to the healthcare industry and the potential adverse impact of government investigations, liabilities and other claims asserted against us; (7) potential competition from other hospitals or healthcare providers, including physicians; (8) the concentration of our facilities in a small number of states; (9) the impact of interruptions to or changes in our information systems; (10) our ability to obtain adequate levels of general and professional liability insurance; (11) our ability to ensure confidential information is not inappropriately disclosed and that we are in compliance with federal and state health information privacy standards; (12) the resources needed for, or unforeseen liabilities related to, future capital commitments, acquisitions or joint ventures; (13) our ability to integrate and improve successfully the operations of acquired facilities; (14) our ability to enhance our hospitals with the most recent technological advances in diagnostic and surgical equipment; (15) our substantial indebtedness and adverse changes in credit markets impacting our ability to receive timely additional financing on terms acceptable to us to fund our acquisition strategy and capital expenditure needs; and (16) other risk factors described in our annual report on Form 10-K for the year ended December 31, 2011 filed with the Securities and Exchange Commission. Many of the factors that will determine our future results are beyond our ability to control or predict. In light of the significant uncertainties inherent in the forward-looking statements contained herein, readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Capella Healthcare, Inc.

Condensed Consolidated Statements of Operations

(Dollars in millions)

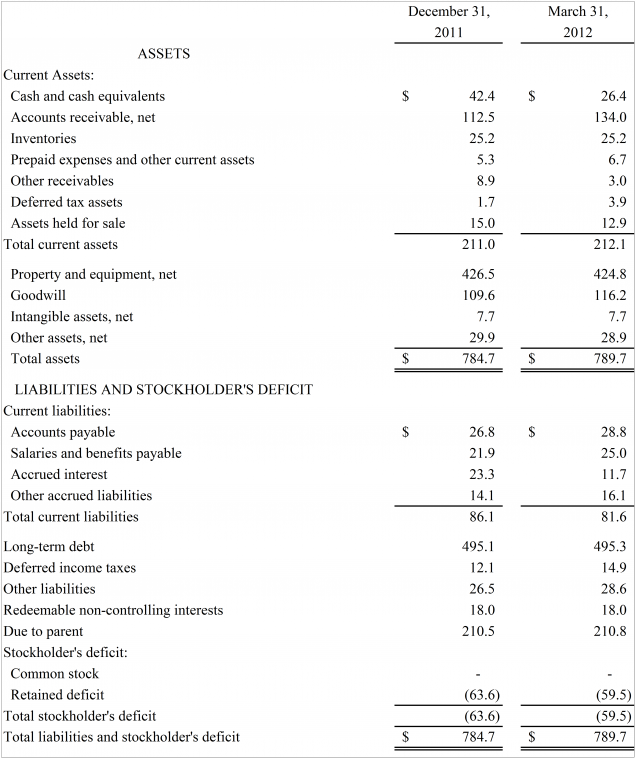

Capella Healthcare, Inc.

Condensed Consolidated Balance Sheet

(Dollars in millions)

Capella Healthcare, Inc.

Condensed Consolidated Statement of Cash Flows

(Dollars in millions)

Capella Healthcare, Inc.

Supplementary Same-Facility Financial Information (1)

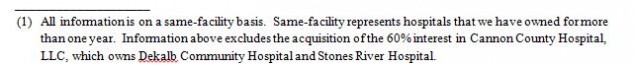

Capella Healthcare, Inc.

Supplemental Non-GAAP Disclosures

Adjusted EBITDA – Reported

(Dollars in millions)

Capella Healthcare, Inc.

Operating Statistics (1)